Colorado Mortgage Broker Silver Mortgage - Since 1981

Colorado Mortgage Origination

Competitive Mortgage Rates. On-Time Mortgage Closings. Fast Mortgage Loan Processing.

Established in 1981. 5-star verified client ratings by TrustIndex.

$0 Mortgage Application Fee. Same-Day Detailed Cost Worksheets. Same-Day Mortgage Pre-Qualification.

Colorado Mortgage Origination

Competitive Mortgage Rates. On-Time Mortgage Closings. Fast Mortgage Loan Processing.

Established in 1981. 5-star verified client ratings by TrustIndex.

$0 Mortgage Application Fee. Same-Day Detailed Cost Worksheets. Same-Day Mortgage Pre-Qualification.

Last Updated: January 27, 2026

Key Takeaways: Colorado Mortgage Broker Services

- Broker advantage: Access to 20+ wholesale mortgage lenders with one mortgage application and one credit report.

- Colorado-specific expertise: VA mortgage loans for Fort Carson military families (25,000+ active duty), self-employed mortgage programs for 600,000+ Colorado business owners, mountain property mortgage financing

- Special situations: Bank statement mortgage loans, DSCR mortgage loans, asset depletion mortgage loans, divorce buyouts, bankruptcy recovery (2-3 years after)

- Service areas: Statewide coverage including Denver, Colorado Springs, Aurora, Fort Collins, Boulder, and all 64 Colorado counties

- Timeline and cost: 21 to 30 day mortgage closings, $0 mortgage application fee

About Steve Silver

Steve Silver (NMLS #314817 ) is a licensed mortgage broker with over 44 years of dedicated mortgage lending experience, beginning in 1981. As the founder of Silver Mortgage Funding Group, LLC (NMLS #360472), Steve Silver focuses on both traditional and non-traditional mortgage financing programs. His areas of specialization include bank statement mortgage loans for the self-employed, DSCR mortgage loans for real estate investors, and asset depletion mortgage loans for retirees. All Colorado mortgage loans are originated through Secure Financial Services, Inc. (NMLS #70160), an affiliated mortgage company.

Colorado Mortgage Loan Programs for Every Borrower Type

We specialize in mortgage programs for mortgage borrowers who don’t fit traditional bank mortgage guidelines. Whether you’re self-employed, a veteran, a retiree with assets but limited income, or buying your first home or investment property, we have mortgage loan programs designed for your situation.

First-Time Homebuyer

FHA mortgage (3.5% down payment), VA Home Loan (0% down payment), and Conventional mortgage (3% down payment).

Learn More →Refinancing

Lower your mortgage rate, reduce your monthly mortgage payment, or tap home equity with a cashout mortgage or Home Equity Loan.

Learn More →Buying Your Next Home

Moving to a larger home, downsizing, or relocating across Colorado.

Learn More →Real Estate Investor

DSCR mortgage loans, portfolio mortgage loans, and no income verification mortgage options.

Learn More →Self-Employed

Bank statement mortgages, P&L mortgage programs, flexible mortgage documentation.

Learn More →Military & Veterans

VA mortgage loans: 0% down payment, no PMI (private mortgage insurance), competitive mortgage interest rates for active duty and veterans.

Learn More →Colorado Mortgage Broker - Silver Mortgage Since 1981

Colorado’s 12 largest cities each have distinct real estate markets,

mortgage considerations, and local factors that affect home financing.

Denver

Denver is home to LoDo (Lower Downtown Historic District ), RiNo Art District (River North), Cherry Creek, and Highlands. Denver International Airport (DIA) covers 53 square miles - larger than Manhattan, Boston, and Miami combined. Union Station at 1701 Wynkoop Street anchors the $5 billion redevelopment.

Colorado Springs

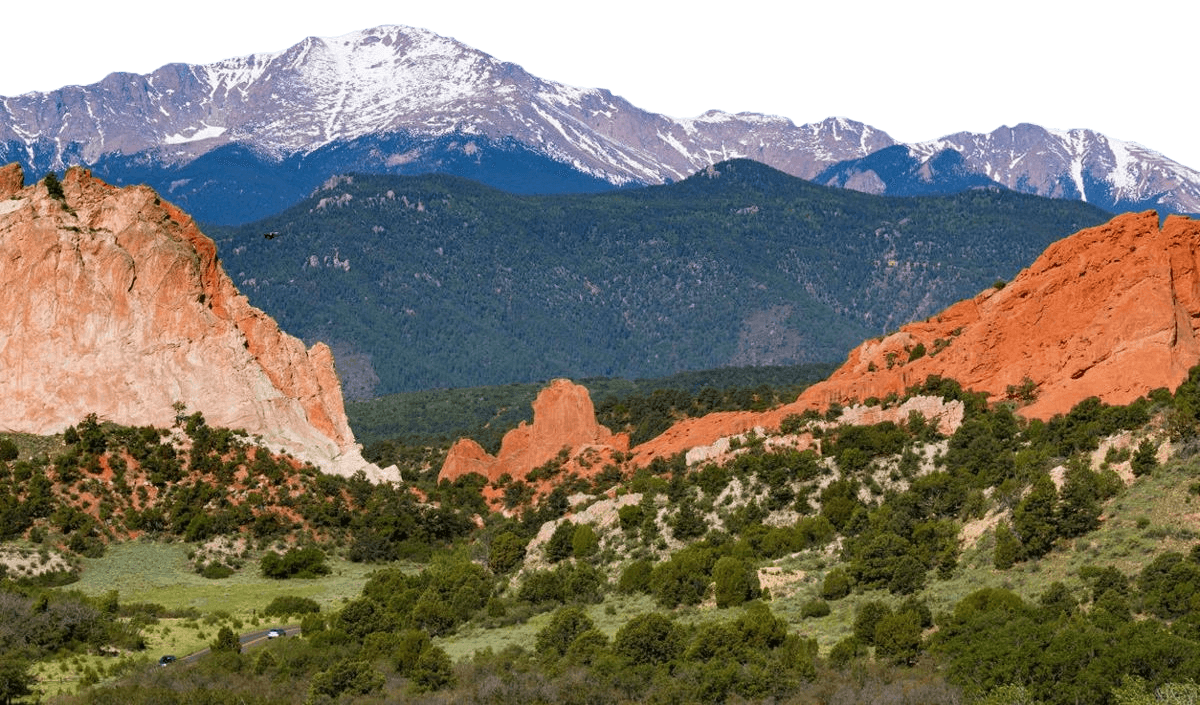

Colorado Springs neighborhoods include the Broadmoor area, Old Colorado City, Briargate, and Rockrimmon. Ranked #1 U.S. housing market for 2025 by Realtor.com. Pikes Peak summit sits at 14,115 feet elevation - America's Mountain with 19-mile Pikes Peak Highway. Garden of the Gods Park spans 1,367 acres with 300-foot red sandstone formations, free admission since 1909. U.S. Air Force Academy covers 18,500 acres with iconic Cadet Chapel.

Aurora

Key Aurora neighborhoods include Stapleton (Central Park ), Southlands, Saddle Rock, and Fitzsimons. Colorado's most diverse city - 40% of residents speak a language other than English at home. Anschutz Medical Campus at Fitzsimons includes University of Colorado Hospital, Children's Hospital Colorado, and $5 billion in medical research facilities. Stanley Marketplace in former Stanley Aviation building (converted 2016) houses 50+ local businesses.

Fort Collins

Popular Fort Collins areas include Old Town Square, Midtown, Harmony Corridor, and CSU campus area. Colorado State University enrolls 33,000+ students driving rental and investment property demand. New Belgium Brewing at 500 Linden Street (opened 1991 ) helped establish Fort Collins as Craft Beer Capital of Colorado with 20+ breweries. Old Town Square features 400+ historic buildings from 1870s-1930s.

Boulder

Major Boulder neighborhoods include Pearl Street Mall, University Hill, Gunbarrel, and Table Mesa. University of Colorado Boulder enrolls 35,000+ students with campus at base of Flatirons. Pearl Street Mall spans 4 blocks (11th to 15th Streets ) - pedestrian-only since 1977. Median home price exceeds $800,000 - highest in Colorado. "Silicon Flatirons" tech hub includes Google, Twitter, and 500+ tech companies.

Lakewood

Key Lakewood areas include Belmar, Bear Creek, Green Mountain, and West Colfax. Belmar redevelopment transformed Villa Italia Mall (demolished 2001 ) into 22-block mixed-use district with 80+ shops, restaurants, and 1,300 residential units. Red Rocks Amphitheatre sits 15 miles west in Morrison - naturally formed acoustics in 300-million-year-old sandstone. Casa Bonita at 6715 West Colfax (reopened 2023 after $40 million renovation by South Park creators) near Gaylord's Garage - Lakewood's trusted Honda/Acura specialist since 1977.

Thornton

Major Thornton areas include Thornton Town Center, Eastlake, Thornton Crossing, and North Washington Street corridor. Ranked #7 best U.S. city for new homebuyers by WalletHub. Water World at 8801 Pecos Street - America's largest family waterpark with 50+ attractions on 70 acres. E-470 toll road provides direct access to DIA (20 minutes ). Thornton grew 18% from 2010-2020 - one of Colorado's fastest-growing cities.

Arvada

Popular Arvada neighborhoods include Olde Town Arvada, Ralston Creek Trail, Candelas, and Leyden Rock. Ranked #10 best U.S. city for new homebuyers by WalletHub. Olde Town Arvada along Grandview Avenue features 1870s historic buildings, 50+ restaurants, breweries, and Gold Strike Days festival (since 1958 ). Arvada Surplus - local institution for hardware, tools, and surplus goods. Ralston Creek Trail connects 12 miles through Arvada to Sloan's Lake in Denver.

Centennial

Key Centennial neighborhoods include Southglenn, Dry Creek, Smoky Hill, and Cherry Hills. Ranked #19 best U.S. city for new homebuyers by WalletHub. Incorporated in 2001 - Colorado's 10th most populous city despite being only 25 years old. Streets at SouthGlenn (redeveloped 2013 ) transformed 1970s mall into mixed-use center. Cherry Creek State Park borders northern Centennial - 4,200 acres with 880-acre reservoir.

Longmont

Major Longmont areas include Downtown Longmont Main Street, Prospect, Twin Peaks, and St. Vrain corridor. Ranked #15 best U.S. city for new homebuyers by WalletHub. NextLight municipal broadband - city-owned gigabit fiber network (launched 2014 ) attracts tech companies. Downtown Main Street features 100+ locally-owned businesses in historic buildings from 1870s-1920s. Longmont sits at 4,984 feet elevation - lower than most Front Range cities, milder winters.

Castle Rock

Popular Castle Rock neighborhoods include Downtown Castle Rock, The Meadows, Crystal Valley Ranch, and Terrain. Fastest-growing Colorado city - population increased 18% from 2020-2024. Castle Rock formation (butte ) rises 200 feet above town at 6,202 feet elevation - iconic landmark visible from I-25. Outlets at Castle Rock feature 100+ stores including Colorado's only Restoration Hardware Outlet. Equidistant between Denver and Colorado Springs (30 miles each direction on I-25).

Mountain Towns

Serving mountain communities including Salida, Vail Valley, Evergreen, Summit County, Pagosa Springs, Montrose County, Mesa County and Durango. Popular with Texas relocations from Houston, Dallas, and Austin for second homes and retirement. - Specializing in vacation home financing, second home loans, and Texas-to-Colorado relocation mortgages statewide.

Colorado borrowers face unique mortgage considerations. Silver Mortgage provides specialized mortgage loan solutions for military VA mortgage loan benefits, self-employment documentation challenges, refinancing opportunities, and non-traditional financing for borrowers rebuilding after divorce or bankruptcy.

Specialized VA mortgage loans for Colorado’s active-duty military at Fort Carson, Peterson Space Force Base, Buckley Space Force Base, U.S. Air Force Academy, and Schriever Space Force Base.

- Down Payment: 0%

- PMI: Not Required

- Closing Time: 21 to 30 days

- BAH Income: Accepted for qualification

- Fort Carson 2026 BAH: E1 ($2,160), E5 ($2,448), O3 ($2,982)

For Colorado’s 600,000+ self-employed workers, these loans offer a path to qualification without tax returns by using bank deposits to verify income.

- Income Source: 12 to 24 months of bank statements

- Tax Returns: Not required

- Application Fee: $0

- Lender Access: 20+ competing lenders

Refinancing can lower your interest rate, reduce monthly payments, eliminate PMI, or switch from adjustable to fixed rate.

- Rate Reduction: Lower interest rate options

- Payment Reduction: Extend term to reduce monthly payment

- PMI Removal: Eliminate private mortgage insurance

- Closing Time: 21 to 30 days

- Lender Access: 20+ wholesale lenders

Mortgage solutions for borrowers in situations that traditional lenders may reject, including divorce, bankruptcy, or non-traditional income.

- Scenarios: Divorce buyouts, bankruptcy recovery (2-3 years)

- Income Types: Asset depletion, DSCR (investment property rental)

- Additional Options: HELOCs, renovation loans, land loans

Frequently Asked Questions: Colorado Mortgages

These 10 frequently asked questions address Colorado-specific mortgage timelines, pricing, qualification requirements, and broker services.

❓ How long does it take to close on a Colorado mortgage?

21 to 30 days on average. We handle all mortgage paperwork and coordinate with title companies, home appraisal management companies (“AMC’s”), and mortgage underwriters to keep your home mortgage closing and funding on schedule.

❓ What’s the median home price in Colorado?

According to Zillow data as of January 2026, median home prices in Colorado’s major cities are: Denver ($635,000), Colorado Springs ($465,000), Aurora ($525,000), Fort Collins ($575,000), Lakewood ($590,000), and Thornton ($560,000). Colorado home prices vary significantly by location. Mountain towns and ski areas (Aspen, Vail, Breckenridge) have much higher prices.

❓ I’m self-employed in Colorado – can I get a home mortgage?

Yes. According to U.S. Census Bureau data, Colorado has over 600,000 self-employed workers (freelancers, contractors, small business owners). Traditional lenders require 2 years of tax returns showing high income. We offer bank statement loans using 12-24 months of business deposits to calculate income. No tax returns required.

❓ I’m PCSing to Fort Carson – how does VA BAH work with mortgages?

According to Department of Defense 2026 BAH rates, Fort Carson service members receive: E1 ($2,160), E5 ($2,448), O3 ($2,982), O5 ($3,300). Lenders use BAH as qualifying income for VA loans. 0% down, no PMI, 21 to 30 day closings. Silver Mortgage understands PCS timelines and military relocations.

❓ Can I get a mortgage after bankruptcy in Colorado?

Yes, but you’ll need to wait. FHA allows mortgages 2 years after Chapter 7 discharge or 1 year into Chapter 13 repayment plan (with trustee approval). Conventional loans require 4 years after Chapter 7. Silver Mortgage accesses 20+ mortgage lenders with flexible underwriting.

❓ What’s the difference between a mortgage broker and a bank?

Banks offer their own loan products. Brokers shop multiple lenders. Silver Mortgage accesses 20+ wholesale lenders with one credit pull, so you can choose the best rates for your needs. Silver Mortgage handles all mortgage paperwork, coordinates the mortgage loan closing, and works for you (not the lender).

❓ I’m going through a divorce – can I refinance to remove my ex-spouse?

Yes. Divorce mortgage buyouts allow you to refinance the existing mortgage, remove your ex-spouse from the title and loan, and potentially cash out home equity for settlement. You’ll need to qualify for the new mortgage loan on your own income.

❓ I’m retired with assets but low income – can I get a mortgage from Silver Mortgage?

Yes. Asset-depletion loans use funds from your investment, retirement, or savings accounts to calculate qualifying income for mortgage purposes. Formula: (Total assets – down payment) ÷ 360 months = monthly income. Silver Mortgage accesses 20+ lenders offering asset-depletion programs.

❓ Does Silver Mortgage charge an application fee?

$0 application fee. Silver Mortgage operates as both a mortgage broker and a direct lender, giving you maximum loan options with one credit pull.

As a broker, Silver Mortgage has access to dozens of wholesale lenders. As a direct lender through non-delegated correspondent lending, we can fund loans directly in-house.

Compensation is either lender-paid or borrower-paid (never both), and Silver Mortgage provides you with the applicable mortgage disclosures, including the Loan Estimate. This dual capability means you get competitive pricing, mortgage product options, and faster mortgage closings when needed.

*Wholesale and Direct mortgage lending services provided through Secure Financial Services, Inc. (NMLS #70160).

❓ What areas of Colorado do you serve?

Statewide. Denver, Colorado Springs, Aurora, Fort Collins, Lakewood, Thornton, Arvada, Westminster, Pueblo, Centennial, Boulder, Greeley, and Colorado cities and counties statewide.

What Our Clients Say About Silver Mortgage – Steve Silver

Here are 6 out of 307 verified reviews across Google, Zillow, Yelp, Facebook and Social Survey.

“Steve is experienced, professional, and is available 24/7. I’ve been sending him referrals for many years, and he has never let me down. One of the main reasons is because he offers extremely competitive rates and fees. Also, he is a problem solver. He knows how to handle difficult situations. He makes closings happen! Before you make a decision, check with Steve first. You won’t be disappointed.”

“The most important quality I value in working with Steve is his trustworthiness. He is ALWAYS transparent, whether it’s about communication, cost estimates, or potential issues. I learned many things from our discussions because of Steve’s enthusiasm for sharing knowledge. His fees are reasonable, and his estimates for closing costs are quite accurate. I highly recommend reaching out to Steve.”

“Steve brings a depth of knowledge in the finance and mortgage industry that’s rare to find. Whether you’re navigating fixed-rate loans, VA, FHA, or more specialized products, his insight is invaluable. What truly sets Silver Mortgage apart is the team’s tireless dedication. They are responsive, communicative, and never let any detail slip—ensuring that every closing is completed efficiently and with minimal stress.”

“Not only is Steve highly intelligent, he has an outstanding ability to build trust and rapport with his clients. He was quick to answer every question we had and went above and beyond in explaining the details of the loan application to us. There was no mystery to the process and his advice and timing were spot-on! We couldn’t have asked for a better guide through the stressful process of securing a mortgage.”

“Steve is extremely knowledgeable regarding current markets and helped us navigate the loan process with ease. He helped us get the lowest mortgage interest possible and tailored the loan to work for us. Steve has gone above and beyond what is required and provided exceptional service. We highly recommend him and we will most definitely work with him for our future financing needs.”

“Solid Mortgage Broker – Works For The Client Not For The Bank. The lending process went very well and smooth. Steve Silver provided excellent service as a mortgage broker. Very knowledgeable and explains in detail the process of the loan application and the working of interest rates. Steve works for the client (homebuyer) and works on providing the best product that is favorable to the home buyer.”

Rated 5.0/5.0 based on 307+ verified reviews across Google, Zillow, Yelp, Facebook and SocialSurvey

Ready to Get Your Colorado Rate Quote?

No upfront costs. No obligations. Local Colorado mortgage company – since 1981.