Section 8 Housing offers landlords a reliable income stream, low vacancy rates, and a chance to support their community by providing affordable housing.

Mortgage Rates Dropped – Here’s Why!

Mortgage Rates dropped this week, and here’s why:

On Nov 1, the Treasury Dept made a stunning announcement.

They stated that for the 4th Qtr of 2023 and the 1st Qtr of 2024, they’re adjusting their debt issuance allocations to DECREASE issuance of 10-year notes (long bond) and INCREASE issuance allocations to short-term T-Bills of just 1mo to 2-year durations.

In other words, they’re not slowing issuance, just reallocating.

Just look at these shocking amounts: $776 billion during the 4th Quarter and $816 billion during the first quarter of 2024

Total those amounts. $1.6 Trillion (with a “T”) in addition to last quarter’s 1.01 Trillion

Why is the US Treasury Reallocating Debt from Long term to Short term?

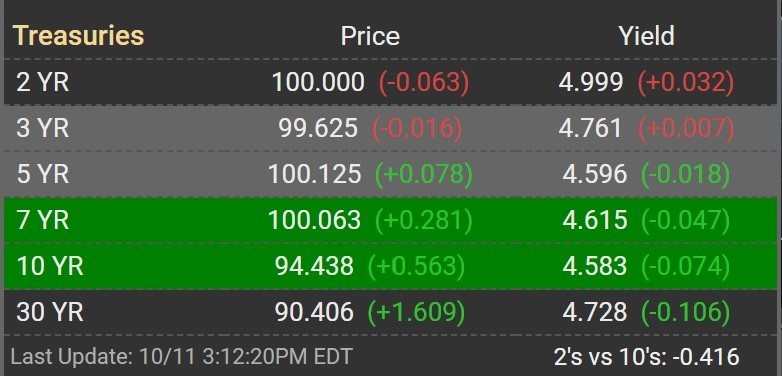

To lower long-term yields (via less supply) while pushing more debt into shorter durations and keep “The Fed” from increasing Fed Funds Rates (and they didn’t).

That helps stocks (witness the red-hot rally) and bonds.

Bond rallies can lower mortgage rates….and they did this week.

Why is the US Treasury doing this?

1) takes some pressure off “the Treasury” as the yield curve “un-inverts (see my recent article about the “Bear Flattener“)

2) lowers expectations of future rate hikes (you’re seeing that expectation today on all the financial channels/blogs)

3) feeds the stock market bubble (by not raising rates)

4) creates the story that “The Fed” is winning “the inflation battle” (or else they’d raise rates)

5) borrow short-term now and then refinance/re-issue later when long-term rates get low enough…similar

to how many homebuyers are viewing today’s mortgage rates

In other words, “politics.”

Are mortgage rates heading down?

In the short term, they’ll likely stabilize and bleed off some margin.

Bleeding off margin lowers rates (even if the FED does nothing).

Long term? The obvious answer is “it depends,” the US Treasury reacts as a function of politics…but rates appear likely to drop longer term to facilitate future financings and refinancing (of rapidly growing) govt debt.

MEANWHILE, elections are next year. The party in power wants to win. That alone signals an easing in rates.

For more information: Contact Steve Silver at Silver Mortgage

NMLS licenses: #70160 Texas #:314817 #360472 Florida #LO91968

For additional contact and licensing information, click here

© 2023 SteveSilverNow

Related Articles:

How Rental Property Tax Deductions Can Dramatically Improve Rental Property Returns – An Example

Urban Gardening: How Homeownership Enables Your Gardening Dreams

Discover Central Texas: A Great Place to Call Home