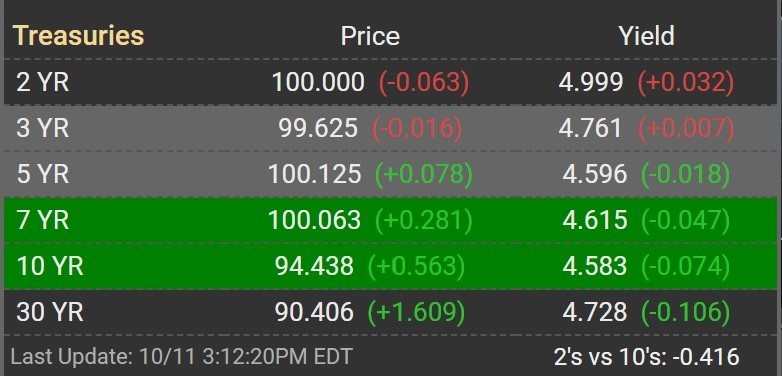

Mortgage rates today dropped sharply thanks to the US Treasury reallocation.

Houston Mortgage Rates: Powerful Mortgage Calculator in 5 Simple Steps

Houston mortgage rates are significant in home-buying and refinancing because they directly influence monthly mortgage payments.

To help you navigate the complex mortgage rates and make informed decisions, we have developed a practical guide showcasing five simple steps to unlock exceptional savings.

Key Takeaways:

- Research current mortgage rates in Houston

- Determine your budget and desired loan term

- Compare different loan products

- Improve your credit score to secure better rates

- Consider the benefits of mortgage points

Now that you have an overview of the five steps, let’s explore each in detail to help you secure the best mortgage rates for your home purchase or refinancing in Houston.

Research current Houston Mortgage Rates

Keep track of the prevailing mortgage rates in Houston by monitoring reliable sources such as financial news, lender websites, and the Federal Reserve. Understanding the trends and fluctuations in the market will help you identify the right time to lock in your mortgage rate.

Determine your Budget and Desired Mortgage Loan Term

- Assess your financial situation and determine how much you can afford monthly mortgage payments. This will help you choose the correct loan term for your financial goals. Typically, shorter loan terms come with lower interest rates but higher monthly payments. In comparison, longer loan terms have higher interest rates but lower monthly payments.

Compare Different Mortgage Loan Types

Compare rates, fees, and terms from multiple loan products from reputable lenders like Silver Mortgage. This will help you identify the best mortgage product that aligns with your financial needs and preferences.

Improve Your Credit Score to Secure Better Houston Mortgage Rates

Your credit score is crucial in determining your mortgage rate. A higher credit score may qualify you for lower interest rates. Take steps to improve your credit score by paying your bills on time, reducing debt, and correcting any errors on your credit report.

For more information, refer to this article on how better FICO scores lead to better mortgage rates.

Consider the Benefits of Mortgage Points to Lower Houston Mortgage Rates

Mortgage points, or discount points, can be purchased to lower your interest rate. One point typically costs 1% of your loan amount and can often reduce your interest rate by 0.25% or more.

Assess whether buying points is a cost-effective option, considering your break-even point and how long you plan to stay in your new home or keep your refinanced loan.

Mortgage Calculation Example for a Home Purchase or Refinance

Suppose you plan to purchase a home in Houston for $300,000 and have a 20% down payment ($60,000). You will need a mortgage loan of $240,000. Suppose the current mortgage rate in Houston is 5.9%, and you opt for a 30-year loan term.

Using the Silver Mortgage Calculator, you can estimate your monthly mortgage payment.

Here’s the calculation:

Loan amount:

$240,000 Loan term:

30 years Interest rate: 5.9%

Based on these inputs, the Silver Mortgage Calculator estimates that your monthly mortgage payment would be $1,423, which includes both principal and interest.

Use the Mortgage Calculator for Buying a Home or Refinancing Your Current Home

Understanding Houston mortgage rates is crucial for home buying and refinancing. It directly impacts your monthly payments and overall financial stability.

Following the five simple steps outlined above, you can unlock exceptional savings and secure the best mortgage rates for your home purchase or refinancing in Houston. Knowledge is power, and with the right approach and tools, you can confidently embark on your journey toward homeownership or a more favorable refinancing option.

Contact Steve Silver at Silver Mortgage, 1-800-920-5720, for more information about Houston Mortgage Rates and Calculating Mortgage Payments in Texas or Florida.

© 2023 SteveSilverNow