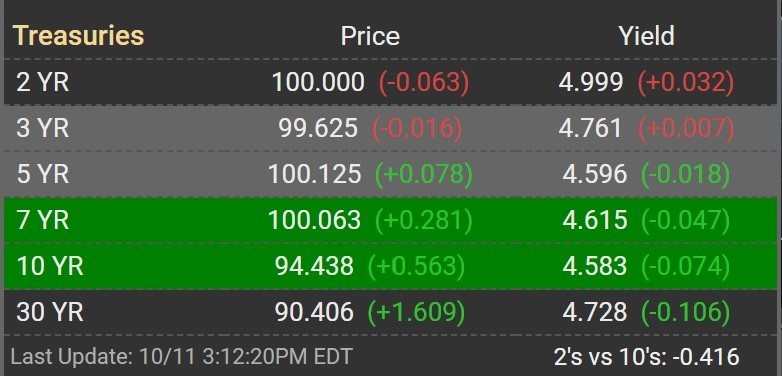

Mortgage rates today dropped sharply thanks to the US Treasury reallocation.

5 Shocking Truths About the Highest Mortgage Rates in History

Key Takeaway: The highest mortgage rates in history peaked on October 9, 1981, at 18.63%, and the lowest mortgage rates were on January 7, 2021, at 2.65%, according to the Federal Reserve Bank of St Louis.

I. The Inflationary Period of the 1980s

According to the Federal Reserve, inflation rose to 14% in 1980.

This inflationary period was fueled by several factors, including the oil price shocks of the 1970s, which saw the price of oil quadruple from $3 per barrel in 1972 to over $12 per barrel in 1974, according to the U.S. Energy Information Administration. This drastic increase in energy costs had a ripple effect throughout the economy, driving up the cost of goods and services.

Today’s Inflation (as of June 2023) is at 4%, down from 9.1% one year ago in June 2022.

II. The Federal Reserve’s Response

In response to the escalating inflation, the Federal Reserve, under the stewardship of Chairman Paul Volcker, implemented a policy of monetary tightening in November 1979. This involved a significant increase in the federal funds rate, influencing other economic interest rates, including mortgage rates.

The federal funds rate, around 11% in 1979, skyrocketed to 20% on March 18, 1980, February 1, 1981, and May 8, 1981.

III. The Impact on Mortgage Rates

This drastic policy shift directly impacted mortgage rates, propelling them to the highest levels in history (data on mortgage rates is only reliable since 1971).

On October 9, 1981, the average rate for a 30-year fixed mortgage reached 18.63%.

This high cost of borrowing had profound implications for homebuyers and the housing market. Home sales declined as potential buyers were priced out of the market. The construction industry also slowed down as the demand for new homes decreased.

IV. The Aftermath and Lessons Learned

The aggressive strategy of the Federal Reserve eventually succeeded in curbing inflation, leading to a gradual decline in mortgage rates. By December 31, 1980, mortgage rates had fallen to 14.95%, and they have continued to trend downward.

On January 7, 2021, mortgage rates hit an all-time low of 2.65%.

Then mortgage rates began to rise again. At the time of this article (June 2023), mortgage rates are 6.69%. At the same time, inflation is reported at 4% after peaking at a much higher 9.1% one year ago, in June 2022.

V. Conclusion

While we are not grappling with 18% mortgage rates today, the lessons from this era remain relevant. They remind us of the potential volatility in the housing market and the importance of economic awareness.

Contact Steve Silver at Silver Mortgage, at 1-800-920-5720.

NMLS licenses: #70160 Texas #314817 #360472 Florida #LO91968

For additional contact and licensing information, click here

© 2023 SteveSilverNow